Maintaining compliance is crucial for NGOs to ensure transparency, build trust with stakeholders, and continue receiving funding. Here’s a comprehensive guide to the essential compliance requirements for NGOs in India for the year 2025.

DLegal Tech

📅 Key Compliance Deadlines for NGOs in 2025

1. NGO DARPAN Registration & Updates

- Purpose: Registering on the NGO DARPAN portal (managed by NITI Aayog) is essential for NGOs seeking government grants and CSR funding.

- Action: Ensure registration and regularly update organizational details.

- Penalty for Non-Compliance: Ineligibility for government schemes and grants

2. Income Tax Return (ITR) Filing

- Due Dates:

- 31st July 2025: For NGOs not requiring audit.

- 31st October 2025: For NGOs requiring audit under Section 44AB.

- Penalty for Late Filing: Up to ₹5,000 under Section 234F; interest may accrue under Sections 234A, 234B, and 234C.

3. FCRA Annual Return (Form FC-4)

- Due Date: 31st December 2025: NGOs receiving foreign contributions must file Form FC-4 within nine months of the financial year’s end.

- Penalty for Non-Compliance: Suspension or cancellation of FCRA registration; legal action for misreporting.

4. Renewal of FCRA Registration

- Timeline: Every five years; apply at least six months before expiry.

- Penalty for Non-Compliance: Loss of eligibility to receive foreign contributions.

4. Renewal of FCRA Registration

- Timeline: Every five years; apply at least six months before expiry.

- Penalty for Non-Compliance: Loss of eligibility to receive foreign contributions.

5. Registrar of Companies (RoC) Filings for Section 8 Companies

- Forms & Due Dates:

- Form AOC-4: File within 30 days of the Annual General Meeting (AGM).

- Form MGT-7: File within 60 days of the AGM.

- Penalty for Non-Compliance: Fines ranging from ₹10 lakh to ₹1 crore; directors/officers may face penalties up to ₹25 lakh and imprisonment.

6. Employee Provident Fund (EPF) and Employees’ State Insurance (ESI) Contributions

- Due Date: 15th of every month for the previous month’s contributions.

- Penalty for Non-Compliance: Interest and damages as per the EPF and ESI Acts.

📞 Need Assistance?

📩 Contact DLegal Tech Today

- 📧 Email: dlegaltech@gmail.com

- 📱 Phone/WhatsApp: +91 9470958800 / +91 7209026600

⚠️ Consequences of Non-Compliance

Failing to adhere to compliance requirements can lead to:

- Financial Penalties: Substantial fines and interest charges.

- Legal Repercussions: Suspension or cancellation of registrations; potential legal action against the organization and its officers.

- Loss of Funding: Ineligibility for government grants, CSR funds, and foreign contributions.

- Reputational Damage: Erosion of trust among donors, beneficiaries, and the public.

🛡️ How to Stay 100% Compliant: Best Practices

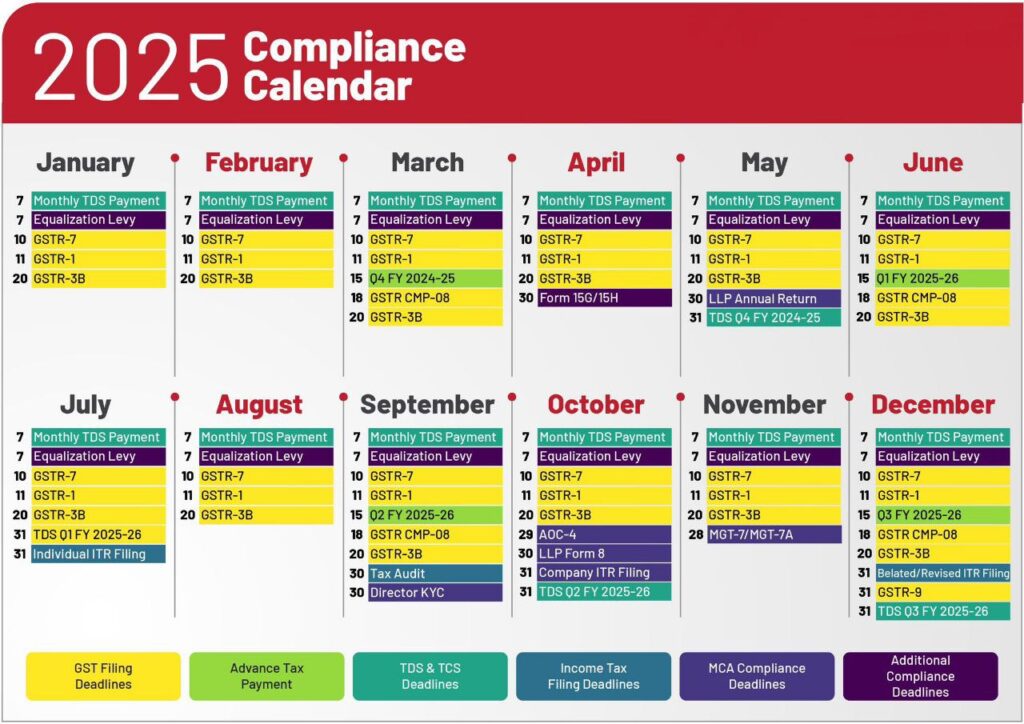

- ✅ Maintain a monthly compliance calendar with alerts

- ✅ Hire qualified accountants and legal advisors

- ✅ Use digital tools or CRM systems for deadline tracking

- ✅ Conduct quarterly internal audits

- ✅ Stay updated with changes via webinars and legal updates

🧠 Need Professional Support for NGO Compliance?

Managing registrations, renewals, legal filings, and taxation can be overwhelming. DLegal Tech is your dedicated partner for:

✅ NGO Registration (Trust, Society, Section 8 Company)

✅ DARPAN & CSR Registration

✅ 12AB / 80G Registration & Renewal

✅ FCRA Registration, Return Filing, and Compliance

✅ MCA/ROC Compliance for Section 8 Companies

✅ Income Tax Return (ITR-7), Audits, and Financial Consulting

✅ Project Report & Proposal Writing

📩 Contact DLegal Tech Today

- 📧 Email: dlegaltech@gmail.com

- 📱 Phone/WhatsApp: +91 9470958800 / +91 7209026600

- 🌍 Pan-India Services | Jharkhand-Based Team of NGO Experts

Mandatory annual compliances include DARPAN portal updates, Income Tax Return (ITR-7) filing, FCRA return filing (Form FC-4), 12AB/80G renewal, and MCA filings for Section 8 companies. Timely compliance ensures eligibility for government grants, CSR funds, and foreign contributions.

Failure to file FCRA annual returns can result in penalties, suspension or cancellation of the FCRA license, and a ban on receiving foreign donations. It may also lead to legal action under the Foreign Contribution Regulation Act (FCRA), 2010

Yes, DARPAN registration with NITI Aayog is mandatory for all NGOs seeking government grants and working with central ministries. Keeping the DARPAN profile updated is essential for grant eligibility.

Yes. If an NGO fails to file returns, submit renewal applications, or maintain proper accounts, it risks losing its 12AB and 80G benefits, making it ineligible for tax exemption and donor tax deductions.